How can I request a Walmart W2 form? Make a request to get the form w2 copy by going to the OneWalmart application/portal, logging in with your credentials, and doing so. Working at Walmart is a lot of fun and a good first step in the direction of a new career. Young people can bridge their expenses by working either part- or full-time, which is a good source of money.

A W2 form is required if you work for Walmart in order to fulfil your tax responsibilities. In any scenario, whether you were a former employee or are still working there, you can get the comprehensive instructions on how to obtain a W2 form if you don’t have one or didn’t receive a W-2 from Walmart.

What Is W-2 Form?

In layman’s terms, a W2 form from Walmart is a record that a business gives to each employee between January 31 and February 28 and contains information on the employee’s annual wage and any taxes taken from their paychecks. This gives the employee an accurate idea of gross income overall, as well as which of the 2023 federal tax brackets for income they fall under.

At the end of the year, this form is also given to the Internal Revenue Service (IRS) and Federal Insurance Contributions Act (FICA).

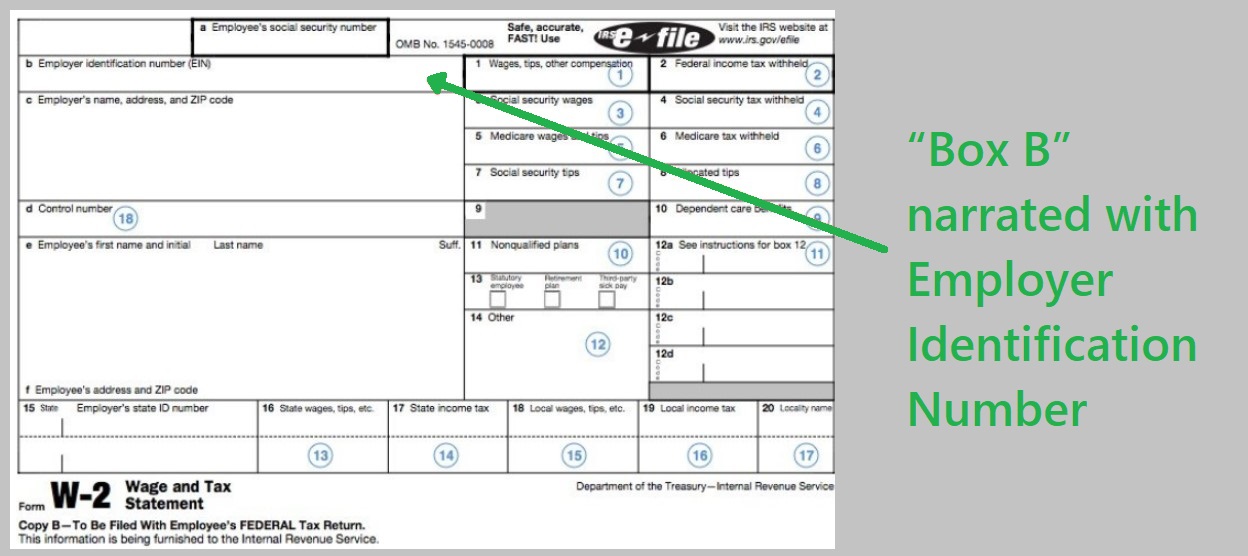

The summary of items on the W2 forms is below:

| Box Name | Narration |

| Box A | Social security number |

| Box B | Employer identification number |

| Box C | Employer name and address |

| Box D | Control number, if any |

| Box E | Your name |

| Box F | Your address |

| Box 1 | Wages and tips |

| Box 2 | Federal income tax withheld |

| Box 3 | Social security wages |

| Box 4 | Social security tax withheld |

| Box 5 | Medical wages and tips |

| Box 6 | Medical taxes withheld |

| Box 7 | Social security tips |

| Box 8 | Allocated tips |

| Box 9 | Any employer benefits enjoyed that no longer exist |

| Box 10 | Dependent care benefits |

| Box 11 | Non qualified plans |

| Box 12 | Compensations or reductions to your taxable income |

| Box 13 | Statutory employee, retirement plan, third-party sick pay |

| Box 14 | Other tax information |

| Box 15 | Employer’s state ID number |

| Box 16 | State wages, tips, etc. |

| Box 17 | State income tax |

| Box 18 | Local wages, tips, etc. |

| Box 19 | Local income tax |

| Box 20 | Locality name |

Does Walmart send W2 forms by mail?

Every firm, including Walmart, usually delivers copies of your W-2 by the end of January or in the first few days of February after the tax year.

Your company or Walmart’s payroll services department may send you a printed copy of your W2 form or, as an option, make it electronically available online.

When does Walmart mail out W2 forms, which are tax and wage statements?

The W2 form from Walmart is a Compensation and Tax Statement document that an employer fills out annually and contains information about an employee’s annual pay and taxes. Each employee at Walmart receives a W-2 form between January 31 and February 28, a date designated by the IRS.

Where Can I Get my W2 form from Walmart?

Check your mailbox first for mail from Walmart’s payroll service department containing a W2 form.

W2s will be delivered throughout tax season.

If Walmart hasn’t sent you a W2 form, you can get a copy of the statement by getting in touch with Walmart’s payroll support department. The department uses a verification procedure to guarantee employee validity.

A former or current employee may also ask a coworker for assistance in locating a misplaced or lost W2 form.

As an alternative, staff members can log in to the OneWalmart portal and submit a request for a copy of a W-2.

Exists a different way to get a W2 form?

After spending hours considering my research, I discovered that some ex-employees are using the “My Tax Form” interface to access current year W-2 records.

In order to view Walmart’s W-2 forms, the portal requires your employer name or employer code 10108 and verifies your identity.

However, access to your recent or current W-2 Forms requires a small cost.

How Can I Be Certain My W2 Form Is From Walmart Inc.?

It is crucial to confirm that Walmart Inc. actually sent your W2 form from Walmart. To achieve this, check the copy of your W2 form for an EIN number that matches the number 71-0415188.

Where May I Find My Walmart W-2’s EIN?

The easiest place to look on your Walmart W-2 is in “Box B” marked with Employer Identification Number if you need to find a 9-digit EIN number.

What Should I Do If a Company Can’t Provide My W2?

However, you have three choices if it does. Which are:

Request the W2 form from your HR department. You might get the Walmart W2 Form with their assistance.

Fill out Form 4852 and send it to the IRS to request an extension of time to file your tax return.

Send a formal written request regarding the W2 form to Walmart’s payroll service division.

What Should I Do If I Discover Errors on My Walmart W2 Form?

I’d like to make the general recommendation that you always check your Walmart W2 form for completeness and omissions of information.

Speak with the employer if the right amount of federal tax wasn’t withheld in order to ensure that the right amounts and information are withheld going forward.

A supplemental Form W-3c can be submitted by the employer if the Form W-2c needs to be corrected in order to reflect changes in the W2 form.

During tax season, does Walmart offer W2 and income tax information?

Yes, each employee for that fiscal year receives a W2 and an income tax statement from Walmart throughout tax season. Please look in your mail for a copy of your W2 form.

To obtain a copy of a W2 form, you can submit a request using your Walmart online account.

What details are required in order to access the online access portal?

You’ll need information like your Social Security Number (SSN), Walmart Identification Number (WIN), and the Walmart employee portal’s website address in order to use the Walmart online access portal.

Final Thoughts

A W2 Form is an employee’s Income and Tax Management Statement that is given by the employer of the business.

This article provides assistance with W2 form from Walmart questions as well as other common ones.

Keep in mind: Ask the IRS for a time extension so that the employer can take the necessary action if Walmart does not have the W2 form accessible.

Frequently Asked Questions

Q.1 How can I access my Walmart W-2 forms online?

Ans: Using OneWalmart or the Walmart employee online access portal, you can download your Walmart W2 Form online.

Q.2 When I no longer work at Walmart, how do I get my W2?

Ans: The Walmart portal for workers allows you to obtain the W2 form if you were a previous employee and your login information is still valid. You can also ask a Walmart coworker who is currently employed there for assistance in obtaining a W2 form. If all else fails, get in touch with the management staff of the payroll department. They’ll support you with this.

Q.3: If I can’t enter into my online employee account, how can I acquire my W-2 forms?

Ans: Fortunately, if you are unable to login through your online employee account details, you can still obtain a W2 form. You can attempt requesting a copy from the IRS since they store the original by contacting them first, followed by the payroll department.